The blog functions as an educational hub covering estate planning, probate, guardianship and fiduciary litigation topics. The blog offers actionable tips and invites readers to contact the firm for personalized advice about how our general tips and information may apply to your situation.. Posts span topics ranging from tax considerations to powers of attorney and mediation options.

Articles & Resources

From the Library of Hardie Alcozer

At a glance

12/20/24

Understanding MERP Claims: What You Need to Know

Digest The Medicaid Estate Recovery Program allows states to seek repayment for long‑term care costs from a recipient’s estate after death. The post explains who is subject to MERP, which assets are recoverable, possible exemptions and why proactive planning is vital. Navigating Medicaid here in Texas and its associated programs can be daunting. One such […]

12/06/24

Guardian of the Estate vs. Management Trust

When someone is declared by a court to be incapacitated as part of a guardianship proceeding, Texas law provides two primary methods for managing their finances and property. These are: the guardianship of the estate and the management trust.

11/15/24

Essential Steps to Take Before Starting Probate

Navigating the aftermath of a loved one’s death can feel overwhelming. The blend of grief and the complex legal tasks that follow can make this difficult time even more challenging. However, understanding the necessary steps to take before starting the probate process can help ease your burden and provide clarity.

11/11/24

Do I Need an Attorney if I’m Named Executor/Trustee?

Taking on the role of an executor or trustee is an important responsibility, but it doesn’t have to be overwhelming. Understanding the risks and complexities involved can help you feel more confident and prepared as you navigate the process.

11/08/24

Trustee Troubles: Pitfalls and Responsibilities in Trust Management

Trusts are established to manage assets for beneficiaries according to specific instructions laid out by the grantor (the creator of the trust), ensuring the goals of the grantor are protected and most importantly carried out in the way they wanted.

11/01/24

The Balancing Act: Navigating the Challenges of 50/50 Business Partnerships

Business partnerships can be immensely rewarding, but disputes among partners can be a massive headache and are more common than you might expect. Even the closest of partners may have disputes, therefore; it’s essential to understand your rights and options if tensions start to rise.

10/25/24

Resolving Trust Disputes: Rights, Modifications, and Mediation

Trust disputes are emotionally challenging and legally complex, especially when the intentions of the trust and the responsibilities of trustees come into question. At Hardie Alcozer, we understand the sensitivity of these situations and have helped countless individuals navigate similar challenges.

10/18/24

Navigating Guardianship: Roles, Responsibilities, and Key Decisions

Guardianship is a legal arrangement designed to protect individuals who are unable to make decisions for themselves due to incapacity.

10/15/24

Power of Attorney Disputes: Understanding Roles, Responsibilities, and Red Flags

Powers of Attorney (POA) are powerful legal tools designed to delegate authority from one person (the principal) to another (the agent). However, disputes can arise when the boundaries of this authority are misunderstood or breached.

10/11/24

True Link Visa Prepaid Cards: Empowering Independence While Ensuring Financial Safety

Managing finances can be challenging under the best of circumstances, but when someone is experiencing diminished capacity, the risks can become more pronounced. Ensuring financial safety while preserving a person’s independence is a delicate balance.

10/04/24

Navigating Medicaid in Texas: What You Need to Know

Understanding Medicaid eligibility for nursing home care can feel overwhelming, but it’s essential for accessing the support you or your loved ones may need. Medicaid is a vital program that helps individuals with limited financial resources cover long-term care expenses, including nursing home services.

09/27/24

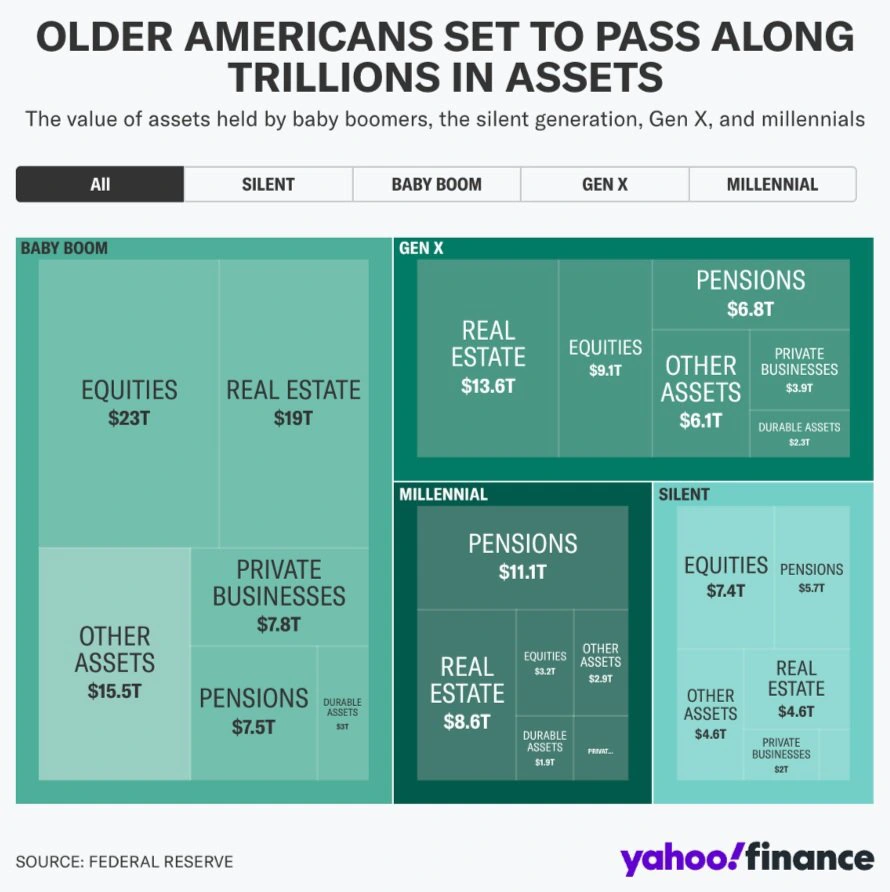

Prepare for the Great Wealth Transfer

The biggest wealth transfer in history is happening right now, and it’s a bit like watching a giant handoff in a relay race—except many families haven’t started warming up yet! With baby boomers set to pass down a staggering $68 trillion in the coming years, you’d think everyone would be ready to grab the baton.

09/20/24

Don’t Forget About the Kiddie Tax!

Before 1986, parents could take advantage of a loophole in the tax code to lower their investment income tax liability by transferring investments to their children’s names. This way, the investment income would be taxed at the child’s more favorable ordinary income rate rather than the parents’ higher rates.

09/13/24

Durable and Medical Powers of Attorney: What can they do?

A power of attorney is a well-known, powerful tool that allows you to give another person the power to make important decisions for you when you are unable to do so yourself. The person who gives their decision-making power to someone else is called the “principal” and the person who accepts the decision-making power is the “agent.”

09/06/24

Understanding Contingency Representation: What You Need to Know

When navigating the legal world, you might come across the term “contingency representation.” This type of legal arrangement offers a unique payment structure, particularly for those who can’t afford upfront legal fees. Car accident cases are the most common examples of claims that are pursued on a contingency basis.

08/23/24

Charitable Remainder Trusts

A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries, with the remainder of the donated assets going to your favorite charity or charities.

08/09/24

Beneficiary Designation Of A Motor Vehicle

People often think that all you have to do to transfer your vehicle upon your death is make your intentions known and hand over the keys. Unfortunately, it’s not that simple. A car has a title that must legally be transferred from one person to another in order to make a valid transfer of ownership.

08/02/24

Transfer on Death Deeds vs. Lady Bird Deeds

Both Lady Bird Deeds and Transfer on Death Deeds (or “TODD”) are essentially beneficiary designations for your real estate. Lady Bird Deeds are a product of common law, whereas Transfer on Death Deeds are product of statute. However, both will allow you to transfer your real estate to your heirs without the need for a probate proceeding.

07/26/24

Different Basis Treatment: Lifetime Gift vs. Death Transfer

There are two main ways in which property is transferred from one individual to another: by death and by a lifetime gift. Interestingly, the recipient’s basis in the transferred asset is different in each situation and results in varying tax consequences. Failing to understand the difference can result in capital gains taxes for the recipient of the property that may otherwise be avoidable.

07/19/24

HEMS Requirement: What does it provide for?

Many trusts provide distributions for a beneficiary’s health, education, maintenance, and support (collectively “HEMS”). This language is used as a standard throughout the estate planning industry because it provides guidance to the trustee on how to manage the trust.